Air Fryer Market Projection: Size & Share 2025–2032

- Reddy S

- Jul 24, 2025

- 4 min read

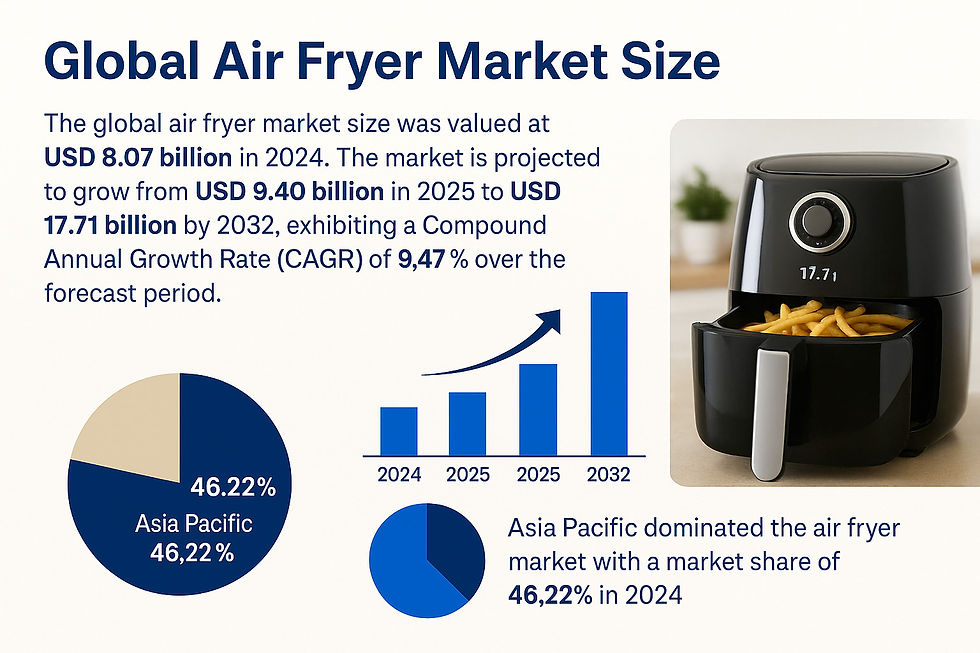

Air Fryer Market Size to Be Valued at USD 17.71 Billion by 2032; Increasing Inclination Toward Energy-Efficient Cooking Devices to Fuel Market Growth: Fortune Business Insights™

Market Overview:

According to Fortune Business Insights, the global air fryer market was valued at USD 8.07 billion in 2024 and is projected to grow to USD 9.40 billion in 2025. It is expected to reach USD 17.71 billion by 2032, expanding at a robust CAGR of 9.47% during the forecast period. Asia Pacific dominated the air fryer market with a market share of 46.22% in 2024.

Air fryers have become increasingly popular in both residential and commercial settings, including restaurants and hotels, due to their ability to cook food with little to no oil. This supports a healthier lifestyle, aligning with the global demand for low-fat cooking methods. As disposable incomes rise, consumers are showing a greater willingness to invest in premium kitchen appliances that offer efficiency and innovation. These trends, along with the product’s ability to cater to a variety of cuisines, are expected to significantly drive air fryer market growth in the coming years.

Request FREE Sample PDF Copy of Air Fryer Market Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/air-fryer-market-107276

List Of Key Companies Profiled In The Report

Groupe SEB (France)

Midea Group (China)

Koninklijke Philips N.V. (Netherlands)

Xiaomi Corporation (China)

Spectrum Brands, Inc. (U.S.)

Faber S.p.A. (Italy)

Conair Corporation (U.S.)

Meyer Corporation (U.S.)

TTK Prestige Ltd. (India)

NuWave, LLC. (U.S.)

Segmentation:

High Demand for Cutting-Edge Cooking Devices Helped Digital Segment Dominate Market

Based on type, the market is segmented into manual and digital. The digital segment dominated the market in 2024 as there is a high demand for cooking appliances that come with advanced features, such as multiple cooking options, digital connectivity, and voice control.

Affordability and Even Cooking to Boost the Usage of Basket Style Models

Based on model type, the global market is segmented into countertop models, toaster oven models, basket style models, and multi-cooker models. The basket style models segment will showcase the fastest growth rate as this model of air frying devices is more affordable than toaster and oven-style air fryers. Moreover, this model facilitates cooking various food items, further accelerating its adoption.

Sales of 3-5 Liter Air Fryers Increased Owing to Demand from Small Families

Based on capacity, the global market is segmented into up to 3 liters, 3-5 liters, 5-6 liters, and above 6 liters. The 3-5 liter segment dominated the market in 2024 as the demand for fryers of this capacity is rising among nuclear/small families as these devices can cook enough food for 2-3 people.

Supermarkets & Hypermarkets Led the Market Due to Availability of a Vast Variety of Products

Based on distribution channel, the market is segmented into supermarkets & hypermarkets, specialty stores, online channels, and others. The supermarkets & hypermarkets segment captured the largest air fryer market share in 2024 as these stores sell a diverse range of products, including affordable and premium cooking appliances.

Rising Inclination toward Oil-Free and Healthier Foods Fueled Product Adoption Across Households

Based on end user, the market is divided into households, foodservice facilities, and others. The household segment dominated the market in 2024 due to the increasing preference for oil-free and healthier foods among fitness enthusiasts.

The global market report analyzes the market’s growth across regions, such as North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Report Coverage:

The report has conducted a detailed study of the market and highlighted several critical areas, such as leading types, model types, product capacities, distribution channels, end users, and prominent market players. It has also focused on the latest market trends and the key industry developments. Apart from the aforementioned factors, the report has given information on many other factors that have helped the market grow.

Drivers and Restraints:

Increasing Inclination Toward Energy-Efficient Cooking Devices to Fuel Market Growth

The demand for energy-efficient products is rising due to various factors, such as the increasing network of commercial housing complexes, the rising number of residential housing units, and the increasing demand for smart homes. Moreover, homeowners are increasing their spending on renovation and interior décor projects, further accelerating the adoption of aesthetically designed home appliances, such as air fryers.

However, higher prices as compared to traditional cooking appliances, will hinder the air fryer market growth.

Regional Insights:

Asia Pacific Dominated Global Market Due to Rising Demand for Digital Cooking Devices

Asia Pacific dominated the global market in 2024 as there is a high demand for digital cooking appliances among customers to help them perform their daily cooking activities more efficiently. The demand for air frying devices is robust in China, Japan, India, and South Korea, which will further cement the region’s dominant position in the market.

North America is also growing at a promising rate in the global market as food companies across the region are introducing recipes that can be made using devices such as air fryers.

Read Detailed Summary: https://www.fortunebusinessinsights.com/air-fryer-market-107276

Competitive Landscape:

Leading Market Players to Launch Novel Products to Expand Their Current Portfolios

Some of the top companies in the market are developing and launching air frying devices with advanced technologies and features, such as digital connectivity, energy efficiency, and multi-mode operations. The launch of these products will help them expand their current portfolio of products and increase their business reach in various regions.

Notable Industry Development:

January 2024: Versuni, a Koninklijke Philips NV-owned small appliances manufacturing company, opened its second 25,000-square-meter factory in Ahmedabad, India. The factory has an annual production capacity of 500,000 air fryers, 200,000 garment steamers, and hand mixers in India.

June 2023: Versuni, a Koninklijke Philips N.V.-owned small appliances manufacturing company, established a partnership with SAP SE, a European software company, to utilize the SAP Sustainability Control Tower to monitor the recycling process of used air fryers in Sao Paulo, Brazil.

February 2023: Tovala, a meal-kit and oven company, launched cloud-connected technology-based smart ovens and Tovala Smart Oven Air Fryer in a sleek stone-gray finish in the U.S. market.

Comments